The base interest rate on home loans, in the form of Euribor, is falling. If you already have a loan, you are enjoying falling loan costs every six months. As competition in the loan market has increased and banks are fighting for customers, this should also bring down banks' lending margins. You can ask for a new offer for an existing loan from either your home bank or another friendly bank. And for new loans, it would be a sin not to ask for an offer from all the banks operating here.

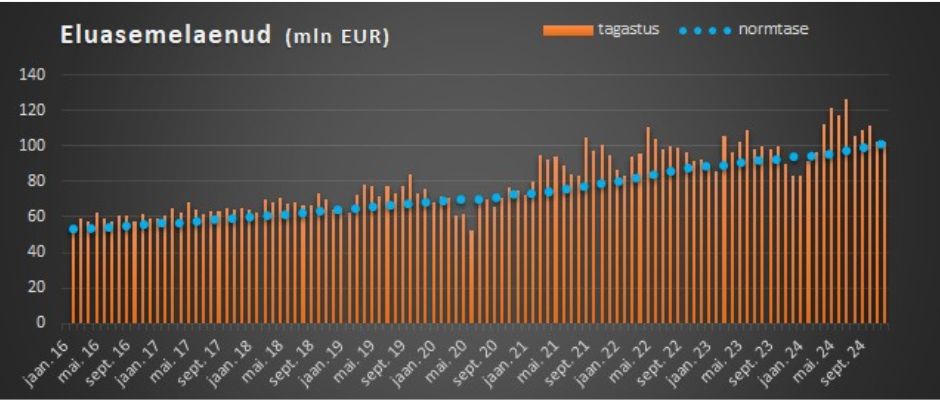

The borrower market became active last April.

The balance of power in the trade has shifted towards borrowers. Statistics from the Bank of Estonia show how many new loans are issued each month and how large the total outstanding housing loans are. However, if you look behind these numbers, you can see that loan repayments have picked up since last April. And it's unlikely that people suddenly just started repaying their loans, especially in the current

in the context of the economic recession, it was more a case of loans moving from one lender to another. To one bank

The old loan with poorer terms was returned and a new loan with better terms was taken from the other. True, this volume was not too large, 10-20 million per month, but it can be assumed that many more changes in loan terms remained an internal matter of the home bank.

Allikas: Eesti Pank

Which bank is the price leader and has won the most market share?

A comparison of the banks' loan portfolios could provide the answer. In total, LHV has grown the most in the past six months, but in percentage terms, Bigbank has shown very strong growth. The growth of LHV and also Coop Pank is to some extent expected, but Bigbank's big jump shows This bank's changed ambition is to enter the housing loan market more strongly from the small loan sector. This also requires the existence of cheap loan resources in order to remain competitive with interest rates.

Why LHV and why not Swedbank?

If you want to be an aggressive market taker, you need to have money to lend out and, on the other hand, a buffer in net interest income, which can be used to lower the bank's own margin. And LHV has a large cash buffer. While other banks have lent out about 78% of all assets, LHV has only 58%. It is true that LHV's even more aggressive lending policy is hindered by capital ratios, i.e. equity capital is lacking. If we look at the next two domestic banks, Coop Pank and Bigpank, then even the smaller Bigbank seems to have a slight advantage in terms of capital availability. If we look at net interest income, which is shaped by the banks' lending margin, then perhaps surprisingly, Coop Pank has made significant positive development. The money taken in has become cheaper and the price of the money issued has been maintained. The larger banks, including Swedbank, have lost a lot in net interest income, including more than 10 million in total. But their net interest income continues to be the largest, so there is a buffer here. It seems that the large banks have not been too aggressively focused on loan portfolio growth and are trying to keep the focus on profitability. In the case of a large portfolio, it is precisely the change based on the existing portfolio that has the greatest impact. But in fact, Swedbank in particular has the room to make the best offer.

Where is the lending market heading in 2025?

Considering that refinancing a home loan is expensive and the drop in Euribor has hurt borrowers, it can be predicted that the fight will primarily focus on issuing new loans. It can be assumed that Bigpank and Coop Pank want to increase their market share, but first they need to solve the problem of raising capital. LHV has money, but needs a larger equity buffer to increase loan volume. Swedbank still has the cheapest money, but they do not seem to be interested in growing in a situation where the bank's profitability has decreased. The same probably applies to SEB Pank.